How Much Credit Card Debt is everyone actually IN?

Welcome back to Asking for a Friend! Today, we’re wrapping up the year with a topic that can feel a bit eek credit cards!

Let’s be honest, many of us grew up being sold the dream that a credit card was a must-have, whether for emergencies or building your credit score. But the reality in Australia? That’s not always the case. For most people, that “emergency credit card” can quickly turn into an emergency Uber Eats card (oops 🙈).

Victoria’s been open in the past about how she doesn’t trust herself with a credit card and honestly, good for her for knowing her limits! On the flip side, some of our team swear by their credit cards, using them responsibly to unlock perks like rewards points and cashbacks.

So, whether you love them, hate them, or are stuck somewhere in between, let’s dive into the good, the bad, and everything in between when it comes to credit cards! We collected data from 1739 people, here’s what we found…

💳 Let’s start with the positives: 68% of respondents feel no regret about their credit card use! This highlights that when managed effectively, credit cards can be an empowering tool rather than a source of stress.

But for some, it’s a different story. 17% sometimes regret their credit card decisions, often stemming from moments of overspending or struggling to keep up with payments. Meanwhile, 15% feel definite regret, which is most commonly linked to unresolved debt. This group often struggles with high balances, interest charges, and the feeling of being stuck in a cycle of financial strain.

So, What Does This All Mean?

Spending & Repayment Insights

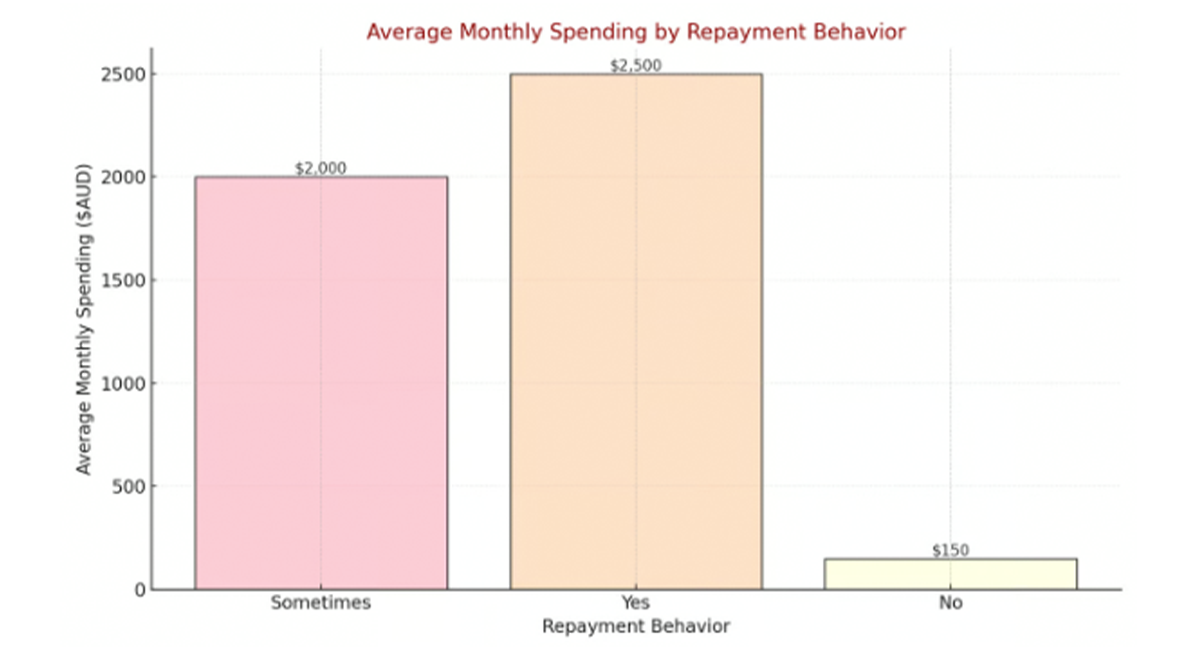

Your approach to repayments makes all the difference in how credit cards affect your finances and peace of mind. The data shows:

Those who always pay off their credit card balance in full each month spend the most ($2,297 on average), but they’re avoiding interest charges and maintaining control of their finances. By using their cards as a tool to budget, earn rewards, or build credit, they prove that spending more doesn’t have to lead to financial regret.

On the flip side, individuals with high levels of regret carry an average debt of $3,955, even though they only spend $660 monthly. This contrast points to a deeper issue: unresolved debt creates ongoing stress, even if current spending is relatively modest. For this group, credit cards may feel like a burden rather than a tool.

What Can We learn From This?

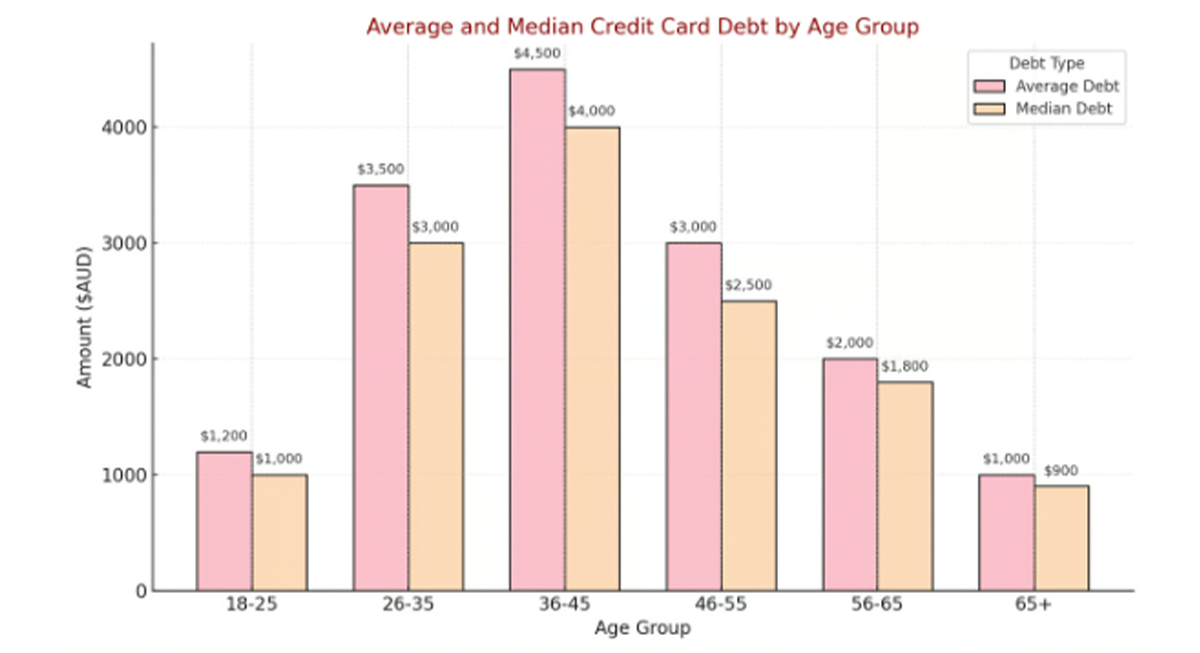

How you feel about your credit card can also depend on where you are in life. Here’s what the data shows about age and attitudes:

Younger respondents (18-35) are the most likely to report regret. This might be due to early financial missteps or learning experiences like overspending, missing payments, or taking on debt without fully understanding the long-term impact. But don’t worry these moments are all part of building financial confidence.

Older respondents (46+), on the other hand, show minimal regret. Over time, they’ve developed strong financial habits and discipline, which means they’re more likely to use their credit cards wisely.

Interesting Fact: Even among people who feel no regret, some still carry significant debt. How do they do it? They’re strategic about their credit card use, leveraging rewards programs, taking advantage of interest-free periods, and ensuring their balances stay manageable.

Credit cards aren’t inherently good or bad—they’re simply a tool. The key is to use them wisely and with intention. Here’s how to stay in control:

Pay off your balance in full whenever possible. Avoiding interest charges is one of the easiest ways to ensure your credit card works for you, not against you.

Stick to a spending plan. Treat your credit card like cash and avoid charging purchases you can’t afford to pay off.

Leverage the perks. Whether it’s rewards points, cashback, or interest-free periods, look for ways to make your card work harder for you—but only if it aligns with your goals.

Stay mindful of your habits. If you’re feeling regret or stress about your credit card, it might be time to reevaluate your spending, set up a repayment plan, or seek advice to regain control.

Want the inside scoop before anyone else? 👀

Sign up for our Asking for a Friend newsletter to get all the stats and stories straight to your inbox, before they hit the web. Bonus: you can even anonymously share your own data to help shape what we talk about next. 💌

Just a friendly reminder: Our content is here to inform and empower, not to provide personalised financial advice. We love making money talk fun and accessible, but when it comes to your own finances, it’s always best to chat with a licensed professional who understands your unique situation. Do your research and make informed choices that work for you!